LESS is MORE - Simple Tips to Fundability!

As an entrepreneur one always wonders - is my company fundable? And if not, why not? I have revenue, I have a team, I have good margins - but nobody seems interested. Or I'm getting what I think is a crappy valuation. And then I hear of some other friend's company that has 10% of my traction and raised $5M - I'm baffled!

Well - the reality is that most businesses are neither fundable nor is funding a necessary or sufficient condition for success. VC's focus on a very narrow spectrum of companies - and most often the answer to the questions below will let you realize yourself if your company is VC-fundable or not.

1. Why you?

Its important to know why you are likely to succeed in the business and others can't. It could be unique domain knowledge, unique business relationships, exceptional technology capabilities, charismatic leadership capabilities or even fearlessness of the unknown - but there has got to be something about you (and the rest of the founding team) that intrigues people. A nice blend of confidence, arrogance and open-mindedness will go a long way in convincing people - especially if you don't have a track-record.

2. Why now?

Timing is everything in startups - if you can't materially move the needle and achieve escape velocity, the company will simply stall and others can catchup. It is critical to time the market right - and the more you can convince yourself and investors that the time is right and in 2 years it will be too late and 2 years ago was too early, the better your chances of being backed. It could be as simple as "SmartPhones have hit critical mass" - and investors are in the business of risk capital, but there needs to be a sense that the time is right for this solution.

3. Aspirin or Vitamin?

At a large corporation, nobody wakes up saying "Today I'm going to take a mission critical use case and pass it to a disruptive new startup". Most often they're thinking "this is a pain point - I wonder if IBM has a solution for me, doesn't matter what it costs".

The only reason to work with a startup is because one cannot find the right solution to a problem that is really hurting them - not because it is slightly cheaper or faster! While this may be less true in a consumer play, its still important.

4. 10x better?

In addition to the Aspirin vs. Vitamin test is the 10x better test. If your solution is genuinely 10 times better than the current state of the art and isn't likely to be copied quickly, then you stand a great chance of being accepted in the market and achieving escape velocity before others catch-up with you.

5. Is it a BIG problem?

This is probably the single-most reason why we turn down startups - as an entrepreneur, even I used to think it was unfair of VC's to do so. After all I will build a solid company making profits and once I'm making millions of dollars of profit, I'll use the money to figure out what else I can do - right?

Well - as it turns out, most startups can only do one thing VERY well - and struggle to do more than one thing. As such it is critical to pick a problem where as a startup you have a differentiator and can build a solid reputation of being the best in that one area - however narrow. That aligns the company completely and it also ensures that the entire team, investors, partners and customers are fully behind your company - because there is 1000% clarity of thought.

6. Who is and who isn't your customer?

Its amazing to see how often entrepreneurs miss out on one critical piece - identifying their real customer - and thus knowing fully well who isn't their customer. As counter-intuitive as it sounds, being clear and turning down business that may seem like an adjacency is critical for the success of a startup.

If you have a solid set of responses to the above 6 questions, there's a high likelihood that you have a fundable business - provided you find an investor that agrees with you - and often you might not need to have the answers to all of them perfectly, but it sure helps ;)

About the Author -

Sanjay Swamy is an Entrepreneur & Early-Stage Fintech Investor! #DigitalPayments & #Financial Services Fanatic! #IndiaStack_Evangelist!

This article was originally published on Linkedin

Recommended articles

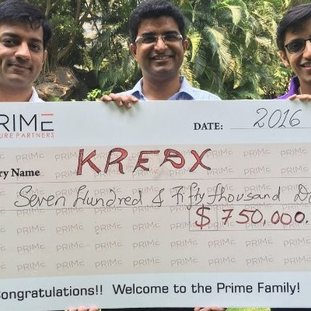

View AllDeconstructing A VC's Mindset - Why We Invested in KredX!

In 2016 we announced our investment in Alternative Financing startup, KredX, led by a terrific founding team.

This blog should …

Read MoreGovernment Should Take Pride in Facilitating Innovation — Not Stifling It!

Recently, both Ola & Uber launched the two-wheeler-taxi — and promptly the local government told citizens that the service was …

Read MoreIf you believe you are building the next big thing, let’s make it happen.