Payments 4G (aka UPI) The Best is Yet to Come!

Last week, India country witnessed the launch of two generational shifts. The one that has everyone excited is Jio, a pure, data-only, high-speed mobile network. The other that is likely to have equal transformational impact is its peer in the world of digital payments, the Unified Payment Interface (UPI). As soon as I had my first experience with UPI, I realized that its impact has barely been appreciated by most, including me.

Why Payments 4G?

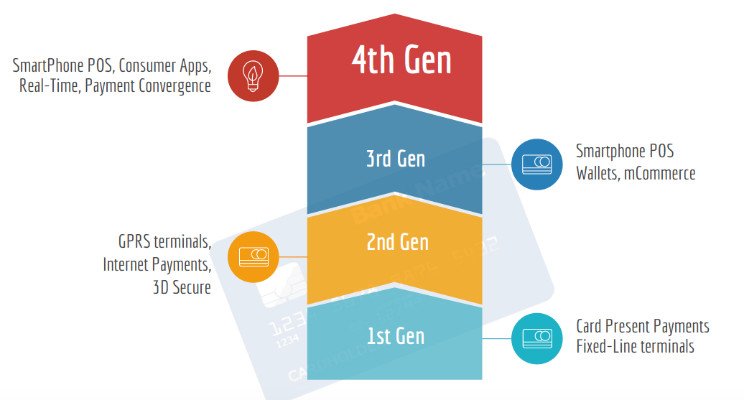

Similar to data networks in telecom, which were built on top of the existing voice/SMS infrastructure, most innovations in Payments are layered on Card platform, a solution conceived in the 70’s. Almost all large-scale payment systems today run on the rails of card-based systems, operated globally by Visa, MasterCard, AmericanExpress and adapted in other regions by companies like UnionPay in China and RuPay in India. While innovators like PayPal, Venmo and Paytm in India have attempted to create close-loop systems, some with more success than others, the interface to the external ecosystem was still mostly card-based.

With UPI, the payment rails have been rethought and built from scratch, a de novo system that was conceived in the year 2015 and implemented within 12 months. From the ground up the system is built with the idea of SmartPhones and Mobile Internet and, like all things in Digital India, ZERO Vendor Lock-in.

A few key capabilities in the UPI architecture are fundamental game changers:

1) Real-time, inter-bank authorization and settlement from one bank account to another: It sure is fascinating to see a live transaction with someone who receives a notification and can do a balance refresh to see their balance updated instantaneously using ANY application!

2) SMTP for Payments: Just as you can use any email client (e.g. Outlook, Gmail to access any email account), UPI has decoupled the payment instrument (application) and store of funds (bank account). During the first week of its launch, two of my colleagues showed me a demo of transferring money between each other’s accounts with the same bank and neither of them was using that bank’s mobile application.

3) Support for all types of payments: It can be anything from one-time, recurring, pull, push, pre-authorized, on-us, off-us, etc. The flexibility in the platform that is exposed to the banking ecosystem as an API is immense.

4) A concept of Virtual Payment Address (similar to an email address) that enables privacy and security and in effect as much of anonymity with auditability and traceability

India has largely been a cash economy. For digital payments to take off, it is important to be able to bring as many of the real attributes of cash as possible, notably in Real-Time, with 100% value and allowing anonymity between payer and payee. Additionally, digital transactions have the benefit of auditability and traceability, both of which are important in the case of dispute resolution.

For once we have a payment system that is built on a whole new rails and I believe its impact will be nothing short of revolutionary. Coupled with the SmartPhone and Mobile Internet penetration and an aggressive business model, there are five areas that will be impacted significantly.

1. P2P - P2P is set for lift-off!

a. Until now P2P payments in India have been largely done in a batch manner using NEFT or RTGS platforms and even with the launch of IMPS (the underlying foundation of UPI), few had used the slightly clunky interface. With virtual addresses, it becomes easy to send money to someone or send a collect request too. This means Social Payments, Bill Splitting, Gifting and other such use cases will come to the fore.

b. Additionally two fundamental changes are likely to happen

i. Informal sector merchants will be happy to accept payments into their bank accounts because they are real-time and zero charge - which can be a great way to get them into the system. Of course once they recognize the value of being in the formal sector, they may have to pay a fee - or alternately a bank may leverage the data for services like loans etc. and keep the payment transactions free.

ii. Everyone automatically becomes an ATM machine , which in essence can be a catalyst for digital transactions. A large part of the population keeps cash because they may not have access to an ATM, but knowing that an ATM is always around the corner will give people the confidence to keep their money digital. One company has built an app to do just this and could be an exciting one to watch.

2. Acceptance - from Rates to ROI/Impact will drive decisions

In the enterprise and mid-market sectors, the previous generation of payments innovation, notably SmartPhone-based Mobile POS solutions that have enabled businesses like insurance companies, e-commerce companies, utilities, police departments, and several others to enable digital payments – although on the same rails as the card system. These initial forays have proven the improvement in agent efficiency and productivity, often an increase of up to 10%.

With UPI, the stage is set for SmartPhone/POS to go mainstream and for payments to be integrated into business workflows. Businesses will hence make buying decisions not based on Merchant Discount Rates but more by choice of applications, availability of SDK’s, breadth of payment offerings and by trying to quantify ROI and productivity gains. We expect such sales processes to no longer be driven by banks but done more in partnership with Application or Flexible Payment platform providers.

3. Consumers - Win with rich choice of front-end applications

Until now, consumers could only transact with a card issued by their bank (credit/debit/prepaid) or the mobile banking app of their bank. With the 4-party model of UPI, consumers can use any UPI-certified app to transact via their SmartPhone. This is a breakthrough in that consumers will be spoilt for choice and can pick the best app. While the initial restriction is that a bank must develop such apps, there are some examples of banks allowing third parties to build differentiated experiences. Over time it is clear that there will be an abundant supply of apps and consumers can use any app they like. While this might seem like banks are giving up control but in reality banks that develop a partner-ecosystem can benefit the most by getting visibility into transactions with customers who may not even be banking with them. It’s surely a shift from the banks’ perspective but a big opportunity nonetheless.

4. Convergence - Online & Offline

Historically in Card-based systems, there was a lot of importance given to Card Present vs. Card Not Present . However as we move to a “Phone-present” world, there is fundamentally no difference between a face-to-face transaction and a remote transaction. We are already seeing use-cases like Uber where the service is delivered in a face-to-face manner but the payments are processed in an online manner. We expect more and more of this to happen and business wise the system should start treating all payments the same. I expect to see one simple business model for payments in the near-term.

5. New Metrics - Mining the digital exhaust

Business Metrics will change – from Stores to Flows!

The most fundamental thing that will change with UPI is the business metrics. In the past for banks, CASA (Current Account Savings Account) count and balances were always the primary metrics that were tracked, along with Merchant Discount Rates and transaction fees. However in the UPI-enabled world and the four-party architecture, it is clear that the most important isn’t just to be the store of funds, but to be in the flow of the transaction.

As such banks will need to start tracking the use of mobile apps by them or partners, use of such apps by existing customers and customers of competitors as well as the use of competing apps by their customers. With switching costs now becoming close to zero, banks that encourage the creation of an ecosystem and giving the maximum choice to their customers are likely to emerge as winners. Mining the digital exhaust will be key for banks to make the most of UPI.

While exciting, it’s still early days in India. UPI has barely gone live in the past one-week, and already we’re seeing some dramatic impact it is having on the system. The next few months and years promise to be truly exciting for the Indian consumer, retail or corporate, as well as the banking sector which stands to gain a great deal from this innovative approach to payments. Indeed the real-time architecture of UPI will truly make it the envy of many a payment regulator and industry expert around the world.

Watch this space, the best is yet to come - but one thing is for sure - UPI will usher in a disruptive step-function in the growth of digital payments in India.

There is no precedent from developed (or any other) economies - India is blazing a new trail and writing the new chapter in the world of Real-Time Payments!

PS: All images are courtesy iSPIRT

About the Author -

Sanjay Swamy is an Entrepreneur & Early-Stage Fintech Investor! #DigitalPayments & #Financial Services Fanatic! #IndiaStack_Evangelist!

This article was originally published on Linkedin

Recommended articles

View AllLESS is MORE - Simple Tips to Fundability!

As an entrepreneur one always wonders - is my company fundable? And if not, why not? I have revenue, I …

Read MoreDeconstructing A VC's Mindset - Why We Invested in KredX!

In 2016 we announced our investment in Alternative Financing startup, KredX, led by a terrific founding team.

This blog should …

Read MoreIf you believe you are building the next big thing, let’s make it happen.