Your startup Is Your Sculpture!

This Women’s Day I Tweeted about a couple of amazing nuggets I had taken away nearly ten years ago from some conversations I had with Vani Kola. It was at the time when I was an entrepreneur and she was an entrepreneur turned Venture Capitalist, in the early days of her VC life.

I have to admit that at that time I didn’t necessarily internalize the implications of what she said - but over the period of 10 years, I must say that several of the points she brought up were more significant and nuanced than I initially appreciated.

As I now work with our portfolio of 15+ companies as a co-founder & Managing Partner at Prime Venture Partners, some of those points apply across all our companies - and I’m sure across all companies. These aren’t trade secrets - in fact most fall in the not-so-common, common-sense category!

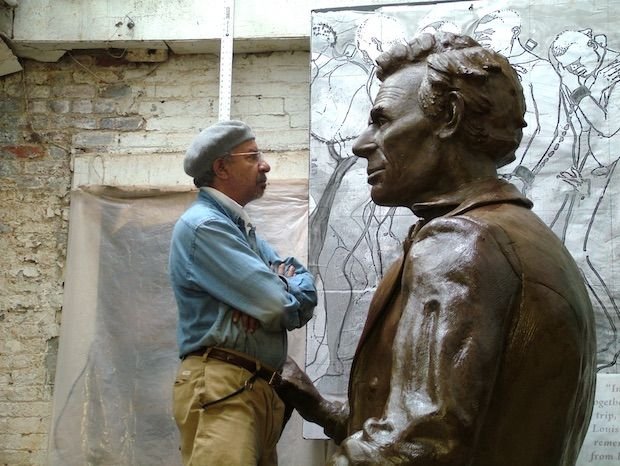

#1: A startup is a Sculpture - one needs to invest in all-round development from the beginning!

Imagine one is carving a full-body statue. One can’t say - let’s just start with the limbs first, the torso next, and then the face and head in the 3rd phase. You have to work on the whole thing simultaneously and gradually keep chipping away and refining it. Of course there will be times when you focus on some parts more than others - but at no point can you lose focus of the big picture.

As human beings, we tend to focus on things we enjoy and hence do well - and nobody likes to do things we don’t enjoy and thus, aren’t good at. Quite often one finds founders with blind spots - some have trouble with marketing and brand building, some with sales, some with team building, some with operations, some with product and some with just getting the culture right. In some cases, they are below par in many areas and you’ll have the problem of death by a thousand cuts. In most cases one area is completely neglected and/or companies may struggle to scale - say in marketing, and unfortunately many a good product dies because of poor all-around execution.

Some might believe that the solution is to hire a team - but ironically founders who don’t understand marketing are least capable of hiring someone who is good in marketing. That requires an inherent ability in the founder to identify the best person for the role, and that can only be done if you understand the role, whether intuitively or by better still, through experience.

One of the recent darlings of the tech industry, AppDynamics, was recently acquired by Cisco Systems for $3.7Billion - and while the company had a solid product, the real value of the company came from their overall Sales & Marketing Execution and commitment to customer delight. It’s clear that this was something that the founders focused on right from the beginning - and it wasn’t an afterthought.

#2: Founders have to make some of the mistakes themselves

This is perhaps one of the most intriguing points for an active investor - one that works closely with founders with the intent of helping get things right the very first time, and avoiding some of the mistakes that the investors have made in their own careers - either as entrepreneurs or have visibility into, based on experiences with other companies.

One would think that entrepreneurs would do their best to avoid making mistakes that others have warned them about. And yet the reality is that some of the biggest strengths of the best entrepreneurs are self-confidence, conviction, perseverance and super-human capabilities. Entrepreneurs rightfully believe that what happened in the past with others, is not necessarily what will happen to them - just because 1+1 wasn’t 11 when you tried, doesn’t mean it won’t be the case for me!

Indeed, founders should have a mind of their own and should experience things first-hand. Mentors, advisors, investors have often got the benefit of first-hand experience - but it was in a different situation and at a different point in time. Smart-founders are those who listen, analyze the situation and make a considered judgement as to whether or not the same rules apply and if the outcomes are likely to be the same or not.

But entrepreneurs ultimately are in the business of taking (calculated) risks- and once they believe they can beat the odds, they may well make the same decision that was previously wrong. Unless they experience it first-hand they will never be convinced that it was indeed the wrong decision! One can merely suggest in such cases that they look out for early signs of failure and quickly shut-down the experiment, if one realizes that “the outcome is obviously going to be negative”.

#3: The CEO has one primary task - make payroll!

This was another gem - quite often as a CEO, one get caught up in tactical activities, day to day activities, enjoy being a missionary and forget some of the most fundamental tasks of being a CEO. A recent Gartner study revealed the top 10 priorities of any CEO.

However, the one non-negotiable part of being a founder-CEO is that at the end of the month the CEO must make payroll. It doesn’t matter if the company is nearly out of money - as long as you can make payroll, in a startup, the founder rocks!

A year back, one of our startups had a near-death experience - the founder realized he had less than 4 months of cash and while he had happy customers, he was simply running out of money. Sure, as CEO, he had many more things to worry about - but the smart young CEO (25 year-old) realized that in order to see the day-after-tomorrow, you have to survive today & tomorrow! Solving his cash-flow problem in 90 days was critical to his survival - and nothing else mattered. He went about changing his pricing and sales strategy on a war-footing and within 60 days ensured that his revenue collections (whether through prepaid licenses, price-protection guarantees or simply new hustle in sales) exceeded his monthly burn.

By focusing on making payroll, this CEO was able to convert a high-risk situation into a company rallying situation, and not only ensured that his company was secure but also that his team was really committed. And, they NEVER came close to running out of money after that - and today are profitable, growing and now that they probably don’t need the money, are able to attract investment.

These three points may each be individually useful to founders - but collectively are invaluable. Thanks Vani for the awesome nuggets - and I hope sharing them helps the entrepreneur benefit meaningfully!

If you have examples of how startups you’ve been associated with have failed because of a lop-sided execution vs. a sculpture-like approach, or where the founders didn’t take chances because someone told them it won’t work, or where the CEO couldn’t make payroll largely because he or she wasn’t focused, do share them here in a confidential manner. No names of individuals or companies - merely your experiences!

Building a startup is your sculpture, your work of art - and a legacy that will hopefully last beyond your time! It’s a gift of an incredible opportunity - make the most of it and do your best to make it count!

About the Author -

Sanjay Swamy is an Entrepreneur & Early-Stage Fintech Investor! #DigitalPayments & #Financial Services Fanatic! #IndiaStack_Evangelist!

This article was originally published on Linkedin

Recommended articles

View AllOne QR Code for All Payments - A Must!

I read with excitement about the launch of BharatQR - a common format QR code for payment acceptance. My excitement …

Read MoreRole of BHIM (Android/*99#) & AadhaarPay

This afternoon the Prime Minister unveiled BHIM - an Android app from NPCI with an equivalent USSD-based *99# service.

Additionally, …

Read MoreIf you believe you are building the next big thing, let’s make it happen.